Our Mission Statement

Alternative asset manager: Actively managed, long-short global macro fund.

“Top-down”approach: We invest in sector champions within growth sectors when markets correct.

Take the stress out of investing by allowing our team of experts to dynamically manage your portfolio.

The United States continues to lead the world in innovation and its financial markets remain the world’s most liquid/ efficient, with the added advantage of the U.S. dollar remaining the world’s reserve currency.

Artificial intelligence, cloud computing, cybersecurity, driverless cars, clean energy, hyperscalers, crypto currencies, etc

Stock prices usually over-shoot, then return to their long-term trend line (“mean reversion”). Markets are sentiment driven and asymmetric; not perfectly rational. Pricing inefficiencies present opportunities to generate “alpha”.

We live in uncertain times, with unprecedented geopolitical risks, emerging superpowers/ cross-border alliances and autocratic regimes in the ascendancy, further complicated by upheavals like AI, cyber threats and climate change. The only certainty is unpredictability/ volatility. Markets are susceptible to “groupthink” (herd mentality) with emotional over-reaction to news flow. Our fund managers therefore have to be nimble, in order to consistently deliver alpha. We achieve outperformance through active trading, amplified by leverage using futures and options. Old school ‘buy and hold’ strategies are no longer viable.

41 years of financial experience, straddling 3 continents and 6 countries. Former Managing Director, BNY Mellon. MBA (Wharton)

41 years of financial experience, straddling 3 continents and 6 countries. Former Managing Director, BNY Mellon. MBA (Wharton)

Billionaire Warren Buffett is arguably the most famous value investor guru. Buffett's style is to buy high quality companies with competitive advantages and hold on to them preferably forever. Buffett tends to only buy things he understands and he would prefer to buy stocks at fair to attractive prices. Many of the investment gurus on our list have also been long term investors who buy quality companies with competitive advantages and hold them for a long period.

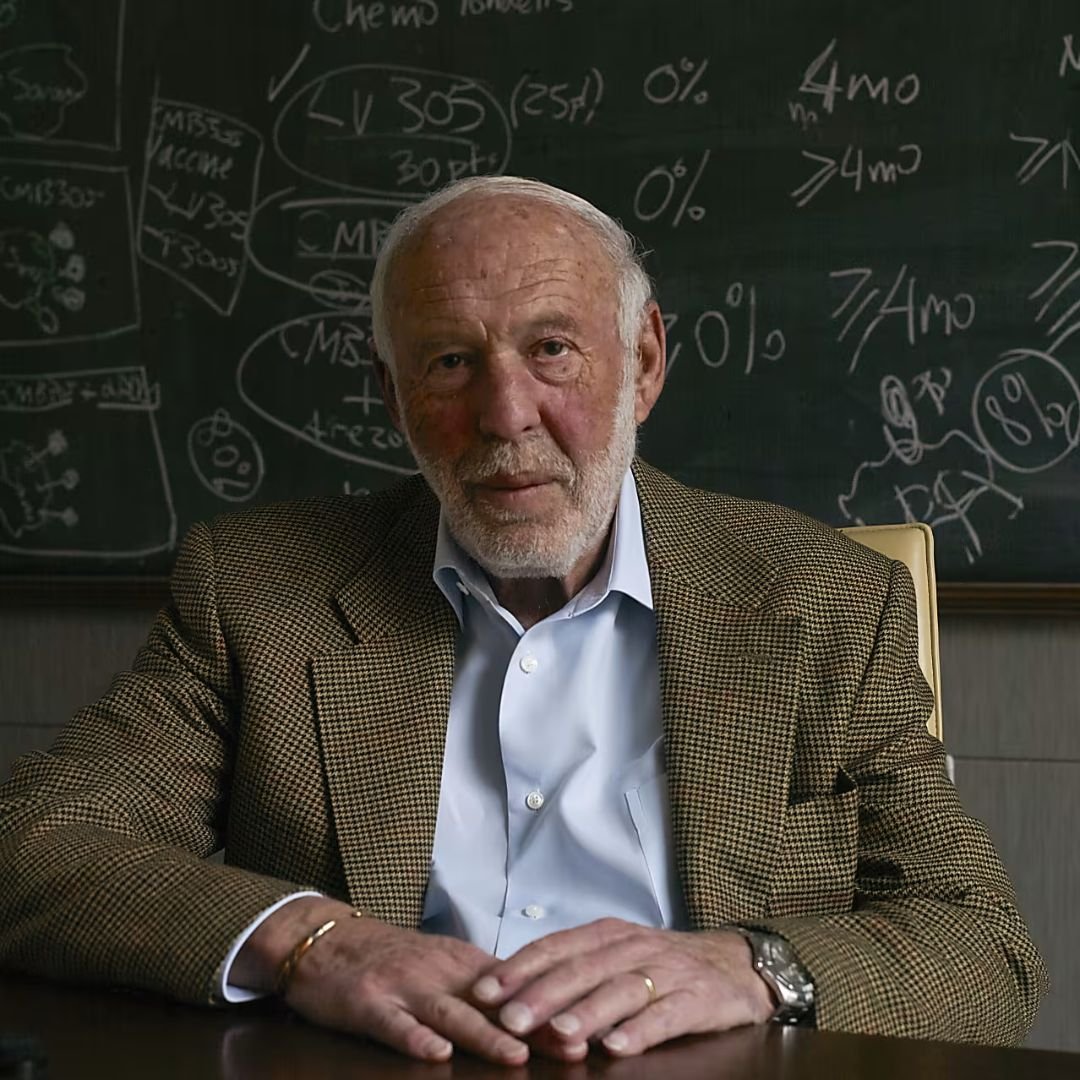

Conversely Billionaire Jim Simons is the founder of what is arguably the leading quantitative fund in the world, Renaissance Technologies which routinely buys and sells thousands of stocks each quarter based on sophisticated computer algorithms.

Jack Bogle: The Vanguard 500 Index Fund Admiral Shares (VFIAX) is a low-cost way to gain diversified exposure to the U.S. equity market. The fund offers exposure to 500 of the largest U.S. companies, which span many different industries and account for about three-fourths of the U.S. stock market’s value. It has a 0.04% expense ratio and its performance in the long term has beaten many active funds over the years.

Liz Ann Sonders, chief investment strategist at Charles Schwab, says market rotation has emerged as the dominant trading pattern, with investors rapidly shifting focus from one opportunity to the next…

Key points: Big selloffs often reflect market mechanics, not broken long-term theses: Sharp drops in any crowded, liquid area (equities, tech, commodities) can spill into other assets via de-risking, liquidity…

Markets now face three distinct, costly scenarios:Base case (60%) : Tensions remain high but limited.Oil settles between $70-80, defense stocks gain steadily, gold, bitcoin BTCUSD -0.38% and cybersecurity stocks thrive.Escalation…

As deglobalization and evolving global trade reshape economic priorities, investors are increasingly turning to regions like Southeast Asia, India, and Latin America for growth. These areas benefit from supply chain…

When it comes to trading, many believe success lies in picking more winners than losers. But in my experience, the real edge comes from understanding one key concept: expectancy. Expectancy…

Most algorithmic trading models rely heavily on regression analysis, which is based on the assumption that historical patterns and relationships will persist into the future. While this can be a…

On Tuesday, the Conference Board’s Consumer Confidence Index for February dropped for the third straight month. It notched the largest monthly decline since August 2021 as expectations for inflation —in…

I view what’s going on right now as part of market structure being fundamentally broken. It’s passive flows, and other people who are investing money mostly care about price, not…

As we look ahead to the end of 2025, forecasts for the S&P 500 suggest a year of moderate growth, driven by a stabilizing economy and improving corporate earnings. Analysts…

The “Magnificent-7” — a group of seven tech giants, including Apple, Microsoft, Amazon, Alphabet, Nvidia, Tesla, and Meta — have been the standout performers in recent years, driving much of…

Linking politics, economics and the performance of financial markets will become even more crucial in the coming years as the investment climate grapples with uncertainties stemming from dramatic political and…

Focus on long-term goals The truth is that retirement savers can’t afford to be rash. Building wealth is a long-term process. “In times of stock market volatility, I tell my…

The Visual Capitalist article ranks the world’s 20 largest economies by GDP adjusted for purchasing power parity (PPP) in 2023. The United States leads with a nominal GDP of $26.9…

ALGOS, which trace back their origins to equities in the 1970s, have become a dominant force in financial markets. They are characterized by the use of computer algorithms to automate…

Summary Russia’s state oil firm Rosneft (ROSN.MM) has agreed to supply nearly 500,000 barrels per day (bpd) of crude to Indian private refiner Reliance (RELI.NS) in the biggest ever energy…

I was in the office of one of my hedge fund subscribers, and he comes in and says, “Doesn’t it feel as though something really bad is going to happen?…